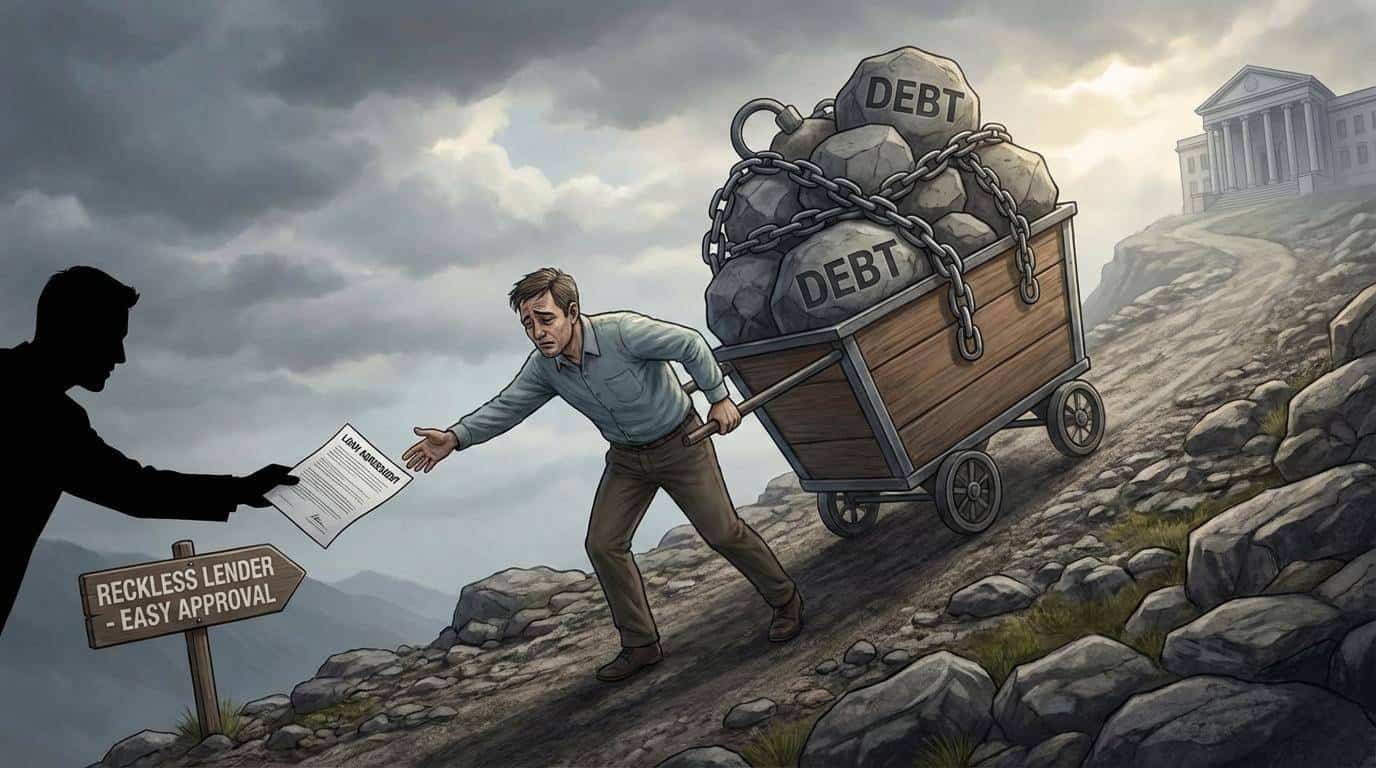

Debt Shouldn’t Be a Life Sentence

Most of us are just trying to get by—whether that’s finally getting a reliable car to get to work or putting a solid roof over our family’s head. Since very few of us have a mountain of cash sitting under the mattress, we turn to credit to bridge the gap. But here’s the kicker: just because a lender says you’re approved doesn’t mean they’re actually playing fair. When a company hands you a loan you can’t afford, they aren’t doing you a favour; they’re breaking the law. This is called reckless lending, and while it feels like a trap, the law actually gives you a way to fight back and regain your peace of mind.

Living on Credit: A South African Reality

Most of us rely on credit for big purchases. While saving is ideal, it’s not always practical. The problem? Millions of South Africans are drowning in debt, often due to reckless lending practices.

What is Reckless Lending?

The National Credit Act protects consumers from lenders who don’t play by the rules. A credit agreement is considered “reckless” if the lender:

- Fails to Check Affordability: Before granting a loan, the lender should assess your ability to repay it. If they skip this step, it could be reckless lending.

- Lends to Someone Who Can’t Afford It: Even if they do an assessment, lenders shouldn’t give you credit if you clearly can’t repay it. This might also be reckless lending.

- Lends to Someone Already Over-Indebted: If you’re already struggling with debt, a lender shouldn’t give you more credit. This can worsen your financial situation.

Over-Indebted? What Does That Mean?

You’re considered “over-indebted” if you can’t keep up with your existing credit obligations. This includes loans, credit cards, and other debts.

Fighting Back Against Reckless Lending:

If you suspect you’ve been a victim of reckless lending, you have rights! A court can:

- Suspend the Loan: The court can temporarily stop your repayments until your financial situation improves.

- Cancel the Debt: In extreme cases, the court may even cancel your entire debt obligation.

Don’t Suffer in Silence!

You don’t have to face this alone! If you’re buried under debt and suspect reckless lending might be the culprit, don’t suffer in silence. A qualified legal professional can review your situation and explain your options. They can help you determine if you have a case against the lender and guide you through the legal process. Don’t wait – take back control of your finances and fight for what’s right!

We Can Help!

Our team understands the complexities of debt and consumer protection laws. Contact us for a consultation and see if you have a case against reckless lending.

Recent Comments