Any person who cannot see Natural Gas (Gas) and Gas-To-Power (GTP) as the short- to medium-term solution to South Africa’s energy crisis is either unaware or ill-informed. South Africa’s energy supply deficit and energy transition to a lower carbon economy must be based on the undoubted availability of Gas resources that this country has been blessed with.

Gas is often perceived as the poorer cousin to Oil. That is because Oil is more marketable, more easily transported, internationally priced and there are a multiplicity of potential purchasers worldwide. Gas, on the other hand, is best anchored in a domestic market and, if sold internationally, requires sizeable discoveries that justify the significant capital investment (Capex) and operating expenditure (Opex) to convert the Gas to Liquefied Natural Gas (LNG) for easier transportation to the global market.

Discoveries of Gas offshore and onshore South Africa by Total Energies and Kinetiko, respectively, have proven the first paragraph to be true as they have demonstrated South Africa’s prospective and contingent Gas resources beyond any doubt. On 1 July 2023, Kinetiko had their Mpumalanga Gas discoveries independently evaluated by internationally recognised resource certifiers, Sproule. It would seem that most South Africans failed to appreciate the significance of the Sproule report. Allow me to translate this seminal report for those that do not understand it.

Sproule attributed to Kinetiko 11,8 trillion cubic feet (TCF) of prospective and contingent Gas resources. 11,8 TCF of Gas equates to having discovered close to a 2-billion-barrel oil-equivalent (bboe) field in energy terms within the heartland of South Africa’s economy.

1 TCF equates to 170 million barrels of oil-equivalent or 0,17 bboe. At today’s Oil Price of USD 81,52 that Kinetiko’s quantity of already discovered Gas is potentially worth approximately USD165,52 billion to the South African economy. Yes, that’s right, say it slowly: one-hundred-and-sixty-five comma five-two billion United States Dollars (USD). Now, how much is that in ZAR? 1,2TCF of proven Gas reserves is sufficient to run a 1GW gas power station or ten 100MW gas power stations for 20 years.

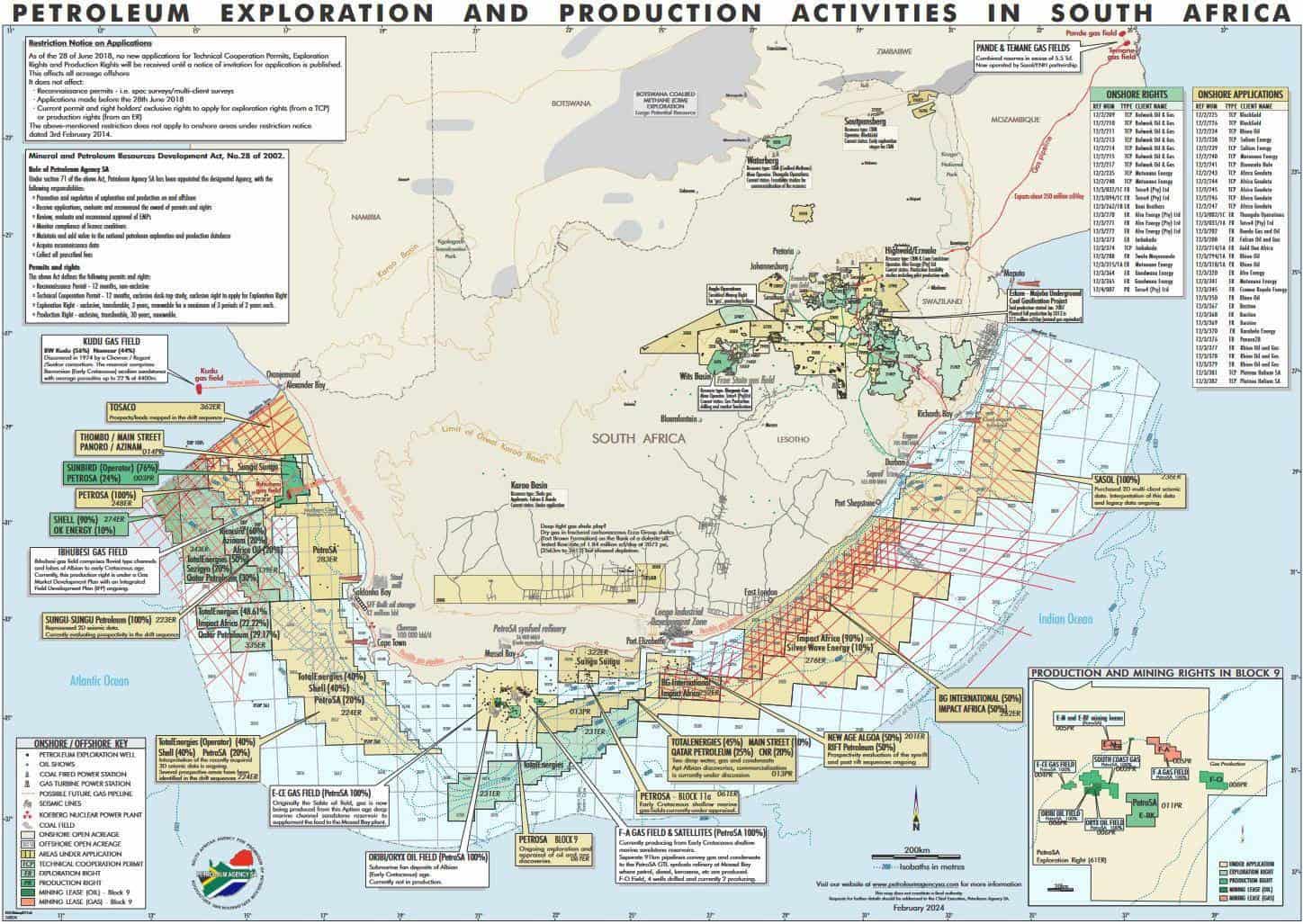

If I have not made my point adequately clear in the aforesaid paragraph, then allow me to emphasize: Recent research reports scientifically project that there is significantly more onshore and offshore gas to be discovered in South Africa. The Petroleum Agency SA (PASA) has estimated, on an unproven basis, that a further 200 TCF of Onshore Shale Gas remains to be discovered. Clearly, the PASA estimates for Coal Bed Methane Gas of 22 TCF have been a relatively conservative under-estimation.

It is obvious that many markets have a negative perception of South Africa as an investment destination. That negative perception is not without good reason and raises its head when transactional due diligence investigations are performed. South Africa has regulatory uncertainty; state institutions that are tainted with well-reported corruption and incoherent state policies that, while seeking to achieve economic growth, in reality impedes it.

It is also concerning that PASA is part of the CEF group and an affiliate to the national oil company. Both have clearly expressed an intention to involve themselves in gas exploration thereby competing with the local and international exploration companies. Lines are once again being blurred and our regulator (being part of the CEF Group and PetroSA desperate for gas) seem to be losing their independence and credibility. As a subsidiary of CEF and reporting to CEF this is a cause of great concern being both “player and referee”. RSA gas exploration companies know all too well that PASA’s last estimates for onshore and offshore gas (unrisked) are outdated and have been underestimated.

Investment capital follows rules. Money has rules and it would be unwise to think that South Africa can become an investment destination of choice if we fail to recognise and continue to break those fundamental rules. South Africa must adjust its investment framework policies by defining clear milestones to achieve regulatory certainty; accelerate administrative processes; cut red tape and deal appropriately with well-funded green lobby groups who unashamedly seek to impede all Gas projects in South Africa and, therefore, its sustainable development in an environmentally responsible manner, whilst providing the South African economy with domestic energy resources and greater energy sovereignty, including independence from importing alternative energy products.

It is also necessary for South Africa’s private sector financing institutions, whose clients are energy-dependent, to play their part by recognizing South Africa’s Gas resource potential; and thus upskill themselves – technically, financially and legally – to understand the industry; competently evaluate and actively participate by investing in South Africa’s Gas industry, whether upstream, midstream or downstream.

For further information, please do not hesitate to contact us.

Barrisford Petersen

barrisford@bbplaw.attorney

Managing Director

Please feel free to visit our updated website: www.bbplaw.attorney

Recent Comments